بدء الاستخدام

Closure Report

The “Cashier Shift Closure Report” provides a detailed summary of a working day at a branch. It’s used to track sales, till cash, cash discrepancies, and any manual cash additions or withdrawals. The report ensures that the actual cash matches the amount recorded in the system.

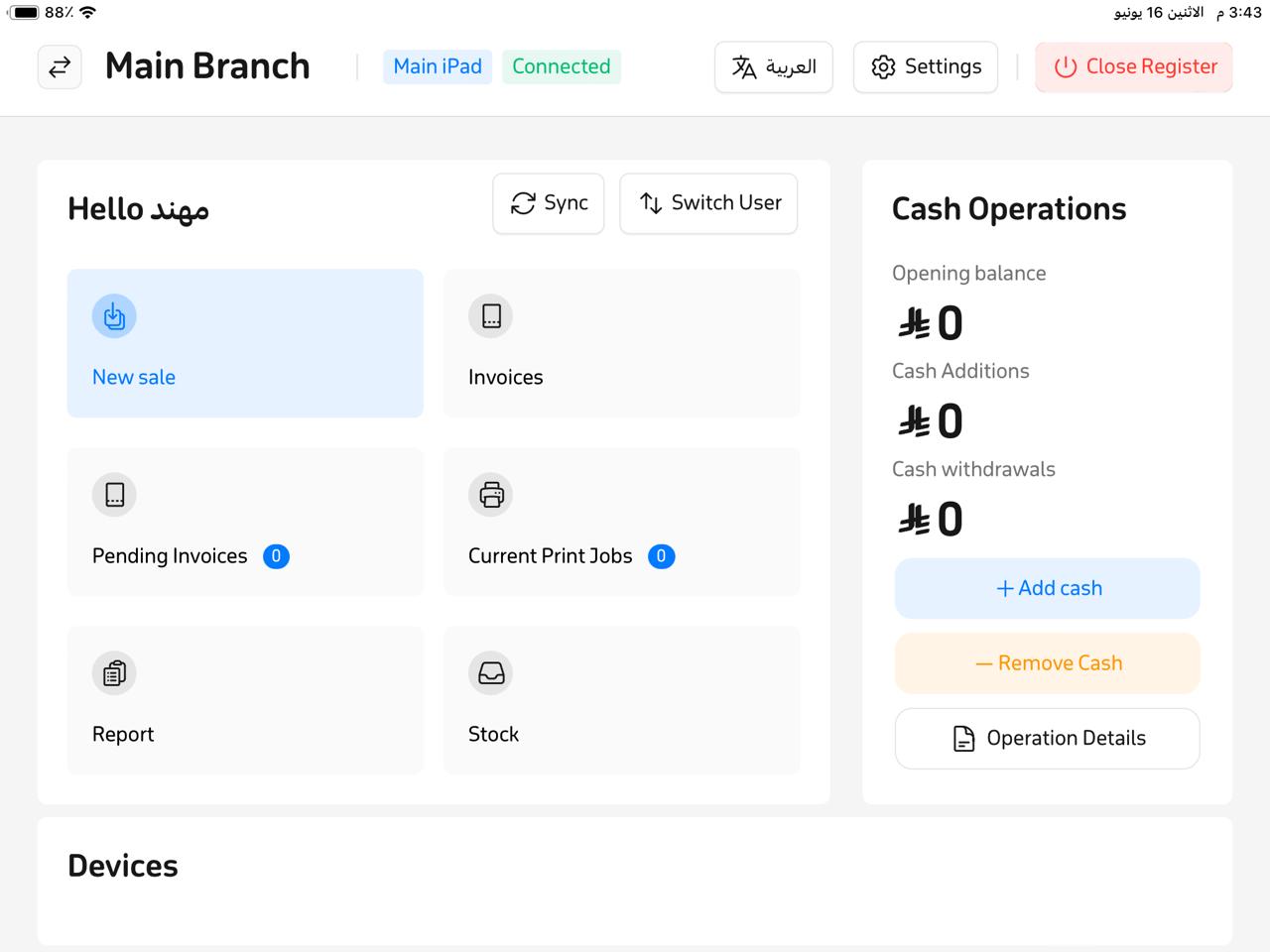

How to Access the Report

- From the main cashier app screen, tap Reports.

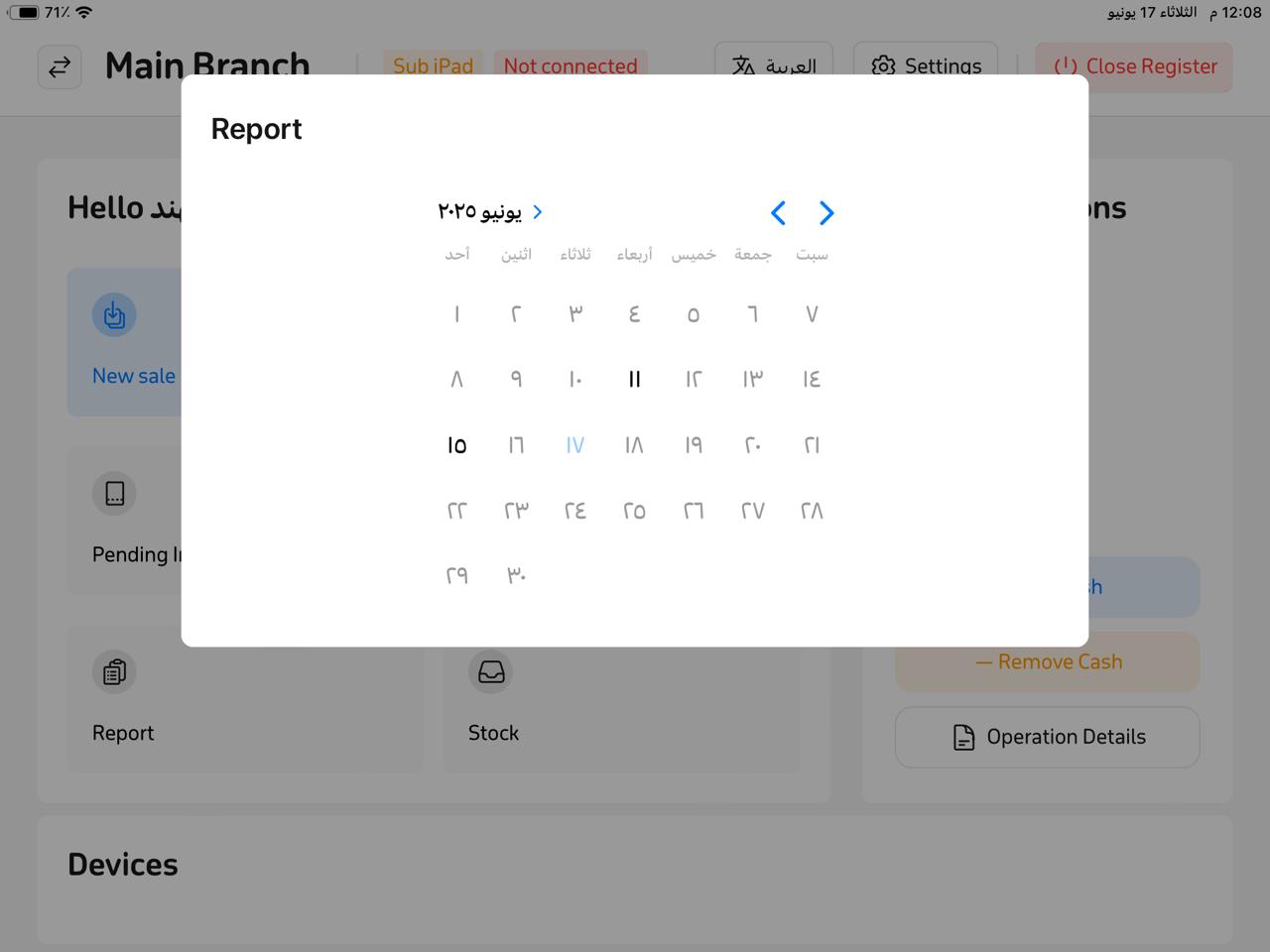

- Select the desired date from the month’s calendar.

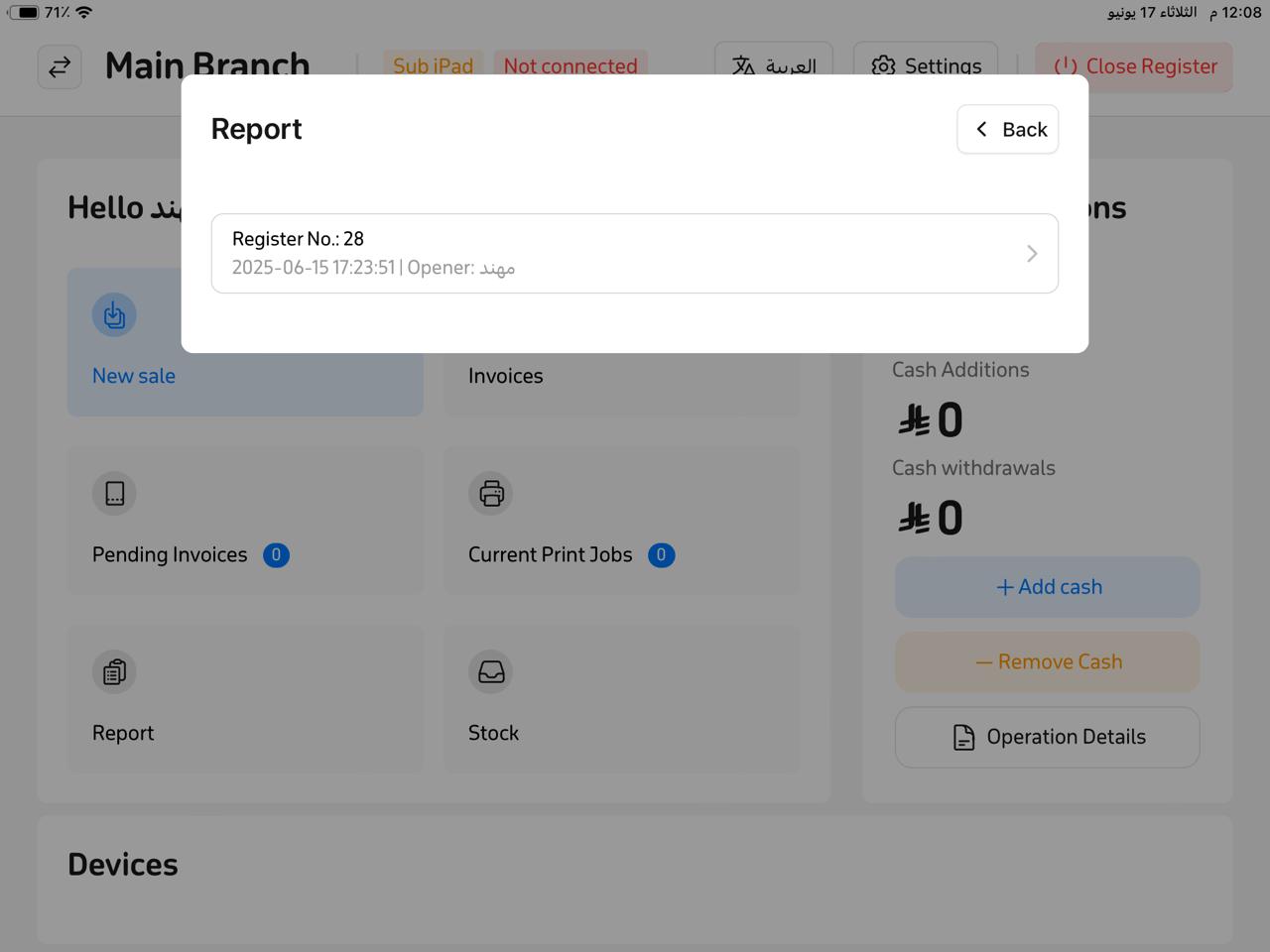

- Tap the displayed shift number.

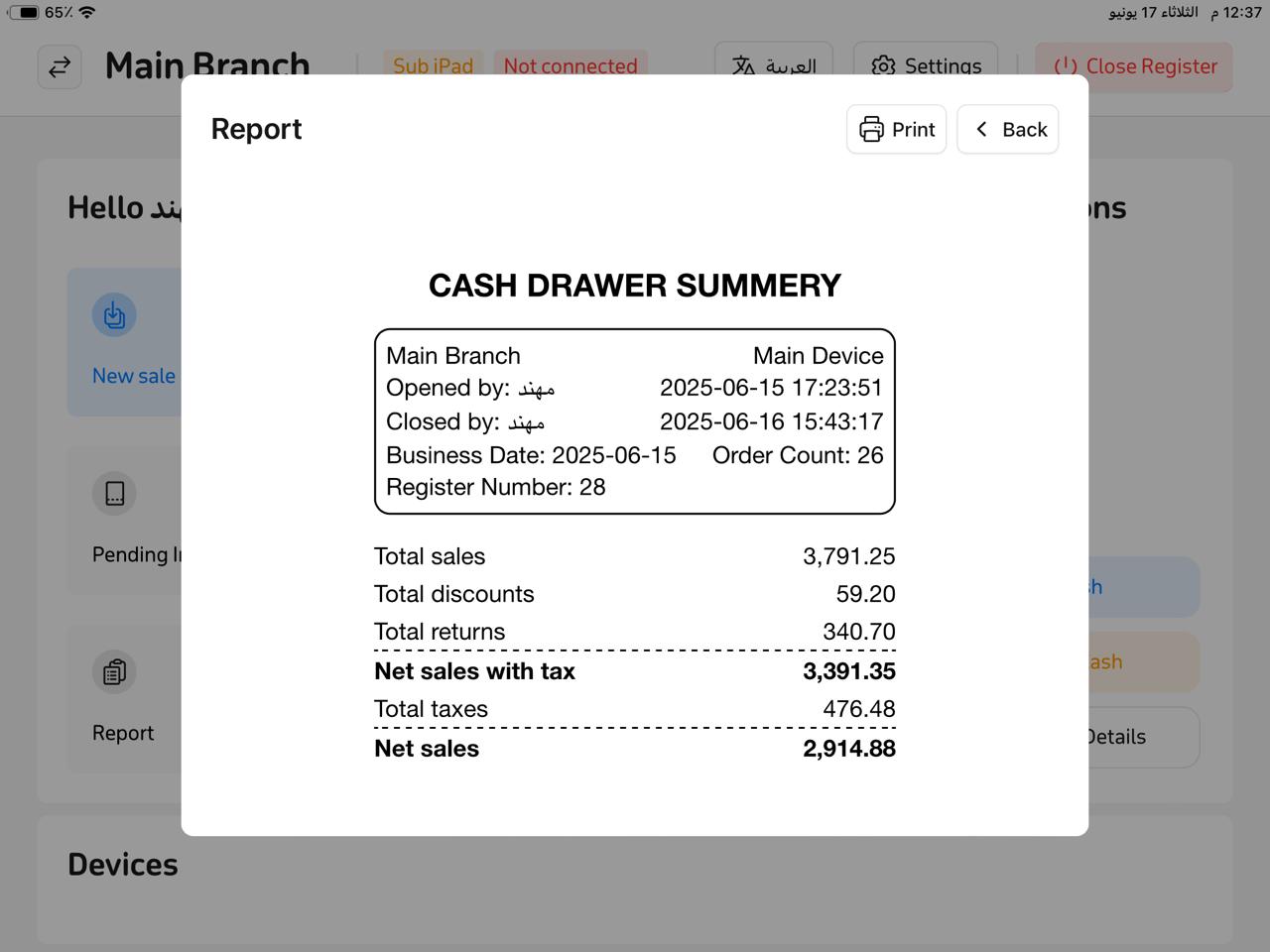

- The report will appear with full details, as described below.

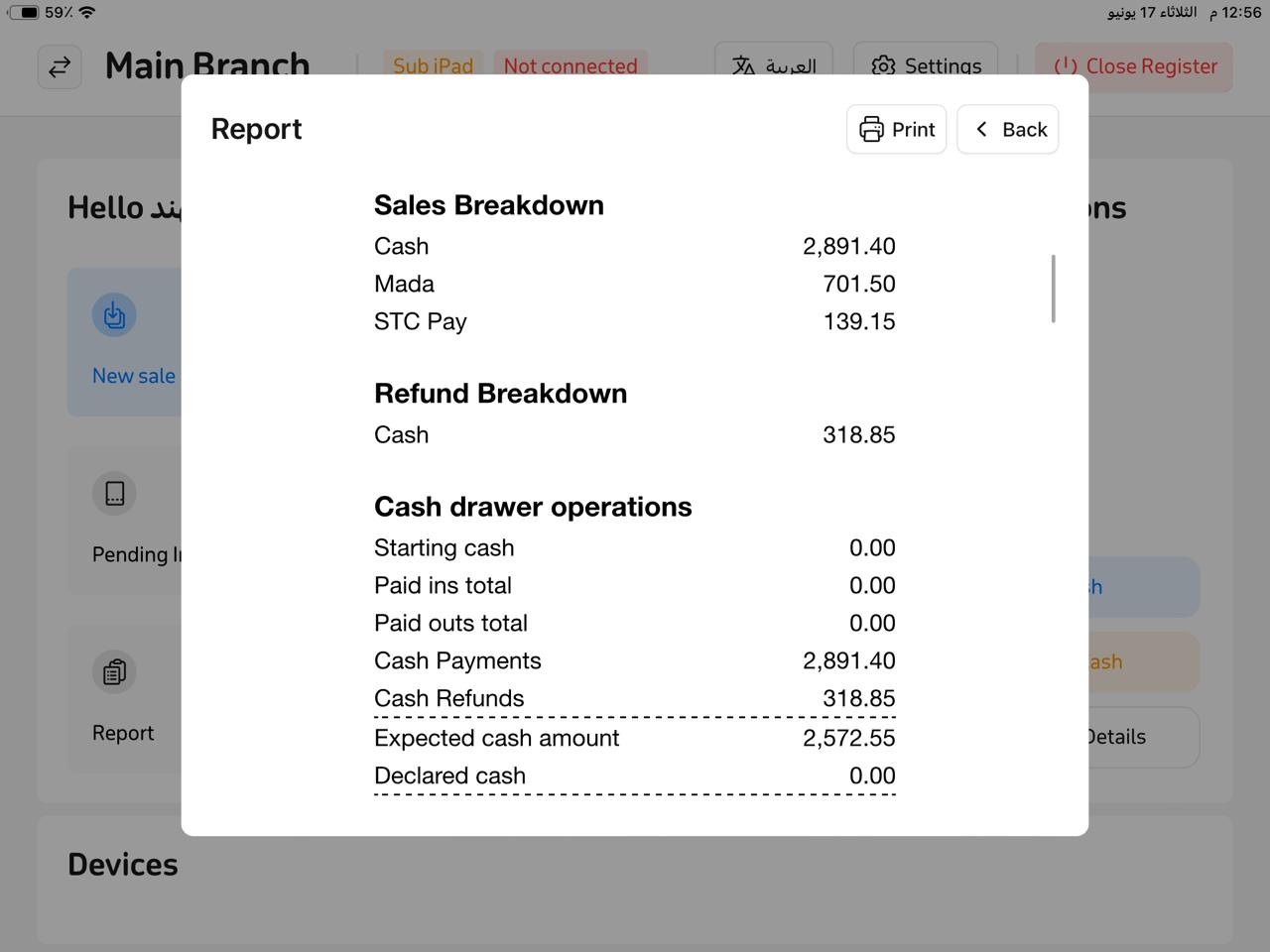

Cash Summary Section

- Branch name: The point-of-sale or branch where transactions occurred.

- Opened by: Name of the cashier who started the shift.

- Closed by: Name of the cashier who ended the shift.

- Business date: The working date for the branch’s operations.

- Shift number: Unique identifier for that shift’s records.

- Total sales: All sales before taxes or discounts.

- Total discounts: Sum of all customer discounts.

- Total returns: Value of items returned by customers.

- Net sales (with tax): Final sales after returns and discounts, including tax.

- Total taxes: Sum of taxes applied.

- Net sales (without tax): Final sales after returns, discounts, and tax deductions.

- Payment breakdown (Cash / Card): Shows how sales were paid—by cash or card.

- Returns details (cash-only): Indicates whether refunds were made in cash.

- Starting cash: Cash in the drawer at the start of the shift.

- Cash added: Cash manually deposited during the day.

- Cash withdrawn: Cash removed during the day (e.g., for operating expenses).

- Total cash sales: Cash payments for sales.

- Total cash returns: Cash refunds.

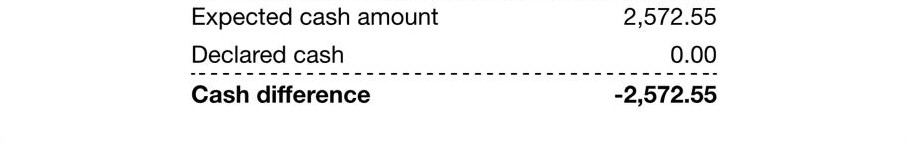

- Actual cash in drawer: Cash counted at the end of the shift.

- Declared cash: Cash amount the cashier entered at the end.

- Cash discrepancy: Difference between actual and declared cash (could be surplus or shortage).

- Cash-in/out log: Details of all cash additions or withdrawals (e.g., cleaning supplies, utilities).

Invoice Details Section

- Branch name, Opened by, Closed by, Business date, Shift number (same as the cash summary).

- Net sales (with tax), total taxes, total discounts, total returns.

- Payments (Cash / Card): Breakdown by payment method.

- Cash refund details: Indicates which refunds were made in cash.

- Total taxes on returns: Tax amounts included in returned invoices.

- Invoice types: Breakdown by invoice kind (e.g., internal, external, ready, hangar, etc.).

Items Section

- Branch name, Opened by, Closed by, Business date, Shift number (as above).

- Items sold: List of all products sold that day.

- Items returned: List of products returned by customers.

Frequently Asked Questions

What’s the difference between declared cash and actual cash?

Declared cash is what the cashier inputs in the system. Actual cash is what’s counted. The difference shows up under “Cash discrepancy.”

What does the shift number mean?

It’s a unique identifier for each cashier shift and its corresponding operations.

Does the report cover drawer expenditures like cleaning supplies?

Yes, all operational cash use is recorded under "Cash withdrawal log."

Why might there be cash discrepancies?

Possible reasons include counting errors or failure to record a cash addition or withdrawal.

Who can view this report?

The branch manager or any staff member with report access privileges.